It has been an interesting journey tracking and visually representing Civil Aviation Authority (CAA) monthly statistics on ATMs, Passenger and Cargo. We hope it has helped airports to quickly see the bigger picture of activity across the UK and to flexibly plan their operations to the changeable demand. Once December CAA statistics are published, we shall make a comparison against 2019 to fully appreciate the impact COVID-19 has had on the airports.

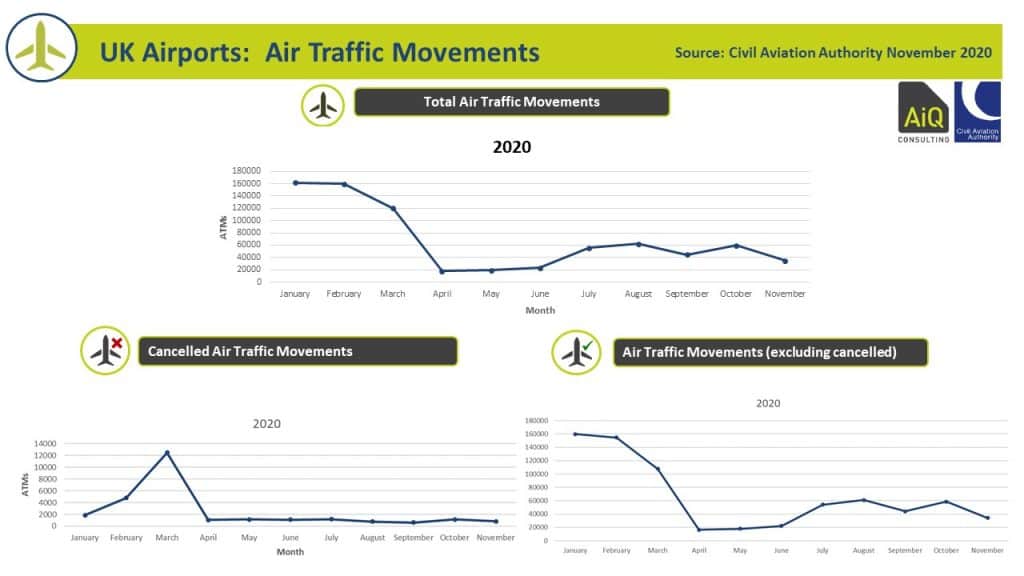

Air Traffic Movements (ATMS) November 2020

Air Traffic Movements plummeted in November by 41% in activity since October to a total of 34,992. After seeing the encouraging spike in October, it is sadly no surprise to this decline due to a sharp increase of COVID-19 cases, the introduction of the tier system and local lockdowns and restrictions enforced once again.

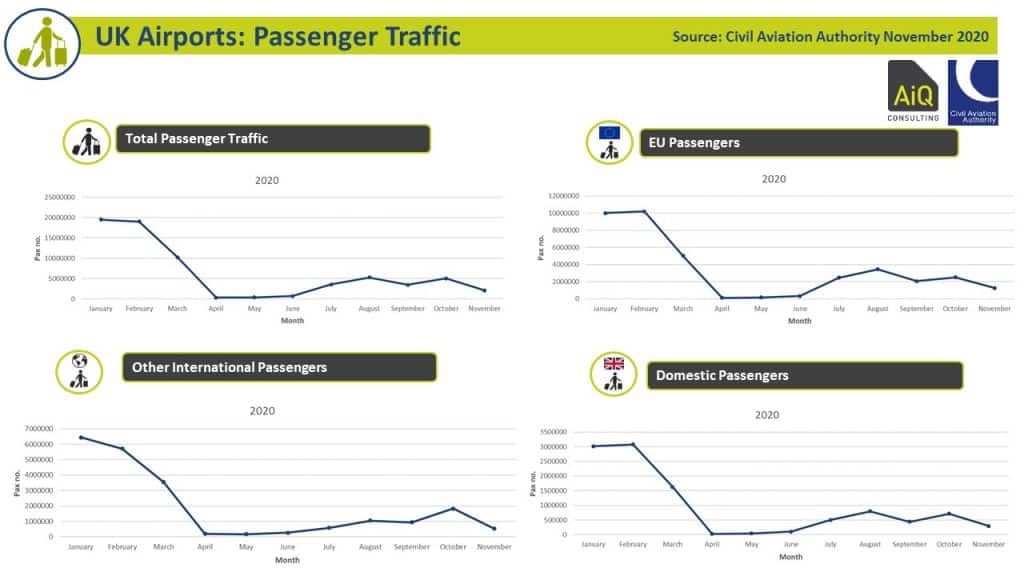

UK Airport Passenger Traffic November 2020

Following the same trend as ATMs, the total UK passenger traffic in November sharply decreases by 58% since October to a total of 2,087,553 in November. As the new infectious strain of COVID-19 virus starts spreading, governments respond to new outbreaks with enforcing local restrictions having a direct result in a decline of passenger travel demand. Vaccine rollouts show positive steps in the fight against this deadly virus for the long term, but the industry remains uncertain in the lead to a slow recovery.

UK Airport Cargo Traffic November 2020

Cargo traffic is faring well during the end half of 2020 with a healthy increase of 14% activity since October to 181,946 tonnes. The pace of recovery for Cargo is picking up due to global trade continuing to trend upwards. As IATAs Director General and CEO, Alexandre de Juniac, said ‘Demand for air cargo is coming back but the biggest problem for air cargo is the lack of capacity, as much of the passenger fleet remains grounded. The end of the year is always peak season for air cargo. That will likely be exaggerated with shoppers relying on e-commerce – 80 per cent of which is delivered by air. So, the capacity crunch from the grounded aircraft will hit particularly hard in the closing months of 2020. The situation will become even more critical as we search for capacity for the impending vaccine deliveries.”

Airports Survival with Operational Optimisation Planning

Tracking the above key statistics provides airports with a clear picture month to month on the impact of the changeable COVID-19 pandemic situation on flight activity. The graphs show passenger demand grinding to low levels and the situation remains uncertain for airports with recovery seeming further away as anticipated. It is ever more important that airports look for operational optimisation opportunities to prevent further squeeze of profits and for the survival of their airport.

As award-winning operational airport experts and experienced business management consultants, AiQ has recently been advising UK airports on applying lean processes, operational efficiency savings along with other simple and practical ways to save money during this challenging time. AiQ Consulting was born from a previous successful management consultancy business and is well placed to help airports through survival from using our 30 years of multisector management consultancy experience. Read our ‘Above Wing’ efficiency savings suggestions and our recently published ‘Below Wing’ efficiency savings ideas to help guide your airport through this survival phrase.

Are you an airport owner, operator, service professional or product supplier who is interested in seeing the above data for your airport? Contact us and we can easily share your airport specific data in a visual graph for your own management planning purposes.